Explore our 2023 Year in ReviewBuilt to scale

Built to scale

all private funds

AngelList provides investors and innovators with the tools to grow.

Better together.

AngelList partners with industry leaders.

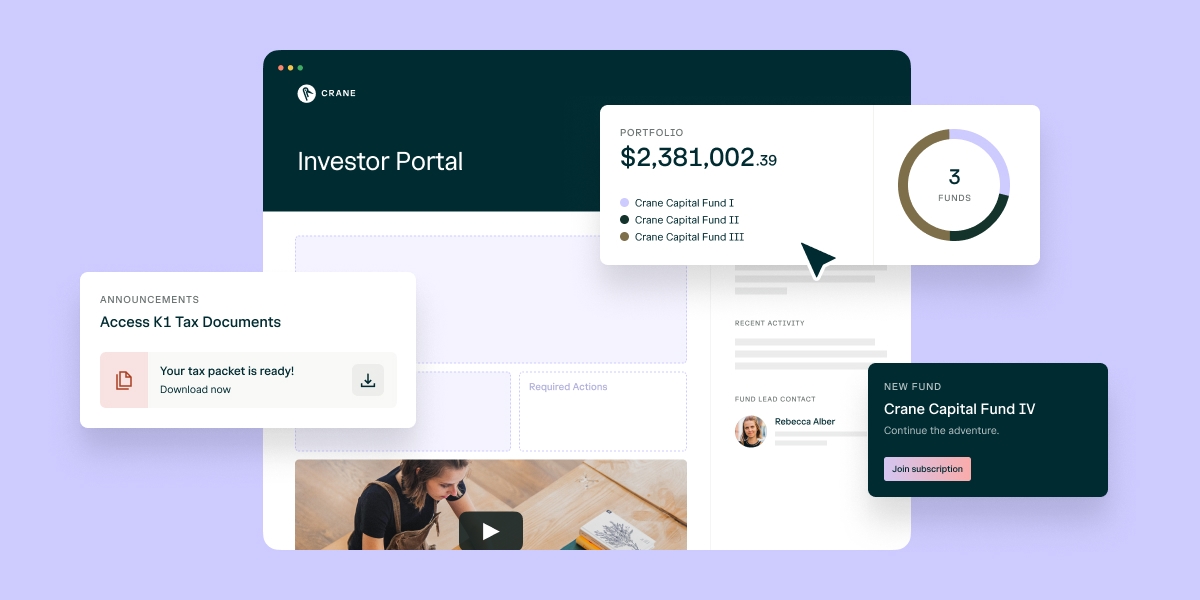

Software for Venture & Private Equity

Our software suite amplifies opportunity for venture and private equity firms, regardless of stage or provider.

A branded, secure doc sharing experience for your LPs.

Explore Data RoomFull Service Fund Management

AngelList’s full service offerings provides access to 50+ services that remove friction from fund management for venture funds, rolling funds, and syndicates.

Explore our fund & syndicate offerings

By the numbers

Fueling innovation

With more than half of all top-tier VC deals run through the platform, AngelList is at the heart of venture investing. This exposure gives AngelList the insight to identify gaps in the VC market and build the solutions that bridge them.

$0B

assets on platform

0k+

funds and syndicates

0k+

active startups

0k+

active investors

$0B

raised by active startups

Testimonials

...it was crucial to get moving quickly and AngelList enabled a seamless launch.

Nichole Wischoff, GP, Wischoff Ventures

Resources